cryptocurrency tax calculator australia

Web CoinSpot Crypto Tax Guide. Web Create a report on crypto activity using a crypto tax calculator like Crypto Tax Calculator Australia.

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

The cryptocurrency tax calculator provides users with an estimate of the capital gains tax incurred when a cryptocurrency asset is sold traded or otherwise disposed of.

. Coinpanda is one of the most popular crypto tax solutions in Australia and provides a fully ATO-compliant tax report that breaks down all capital gains transactions including the CGT discount. Disposing of cryptocurrency purchased with fiat currency a currency established by a countrys government regulation or law Tim purchased 400 USD Tether USDT for A800. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you made this financial year.

Create a report of your crypto activity using a tax calculator like ours. Web If you want to take advantage of the CGT discount the best option is to use a cryptocurrency tax calculator to do all the calculations for you. Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale.

If youre asking yourself how do I calculate crypto tax in Australia then look no further. Crypto Tax Calculator is a crypto tax software platform that. Web Cryptocurrency Tax Calculator Australia.

Rated 46 with 700 Reviews. Web Crypto Trader Tax is one of the most popular cryptocurrency tax calculator platforms on the web. If you sell or swap your cryptocurrency and make a profit you may need to pay tax on that profit as crypto profits are subject to capital gains tax CGT in Australia unless you are a professional trader.

See our 700 reviews on. Its very accurate and simple to use. Web Crypto Tax Calculator for Australia.

Compliant with Australian tax rules. Over 600 Integrations incl. Our Australian crypto tax calculator is the perfect.

As an investor you can use either FIFO HIFO or LIFO to calculate capital gains as long as you can individually identify your cryptocurrency assets. Regardless of your trading history the process does not change and is simple and easy. Web Crypto cost basis method Australia.

Web Yes you do need to pay tax on cryptocurrency in Australia. Web Crypto Tax Calculator Australia. This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates.

Calculate Your Crypto DeFi and NFT Taxes in Minutes. In order to use the cryptocurrency tax calculator effectively youll need to provide a number of specific details about the. It provides users with an extremely user-friendly app which can be connected to all of their exchange platform accounts to seamlessly pull all the necessary transaction history data needed to get an accurate overview of the users tax slots.

As a trader the ATO requires you to use FIFO when calculating your crypto Income Tax. Web The CoinTracking tax calculator for Aussies. Total income tax will be AU5092AU8125 AU13217.

It supports all major exchanges and wallets and offers a range of features to help you stay compliant with the ATO. Web At Crypto Tax Calculator Australia their state of the art application makes calculating cryptocurrency tax easy whether you are a beginner trader or a crypto trading master. Koinly is the only cryptocurrency tax calculator that is fully compliant with ATOs crypto tax guidance.

CryptoTax Calculator is another great option for Australians who want to automate their crypto tax reporting. Find out how Australian crypto tax works in this detailed guide. Further 2 Medicare levy tax on income of AU70000 comes to AU1400.

CryptoTaxCalculator has partnered with leading Australian cryptocurrency exchange CoinSpot offering seamless integration between the two products. Web Using The Australian Cryptocurrency Tax Calculator. Send the report to your accountant to complete your taxes.

Web 5 tax on income from AU45001 to AU70000 which equals to AU8125 in this case. Web Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes. Fill in the necessary information on your tax return and submit it yourself.

Web June 27 2022. Being one of the earliest fully featured trading platforms that facilitate crypto to crypto transactions it exciting for us to offer complete support for CoinSpot users. CryptoTaxCalculator has partnered with leading Australian cryptocurrency exchange CoinSpot offering seamless integration between the two products.

Quick simple and reliable. So your total tax liability for the year will be AU13217AU1400 AU14617.

Do You Mine Coins Whether Your Mining Is Active Passive Or Hobby Income Depends On How Much Time And Personal Bitcoin Mining Bitcoin What Is Bitcoin Mining

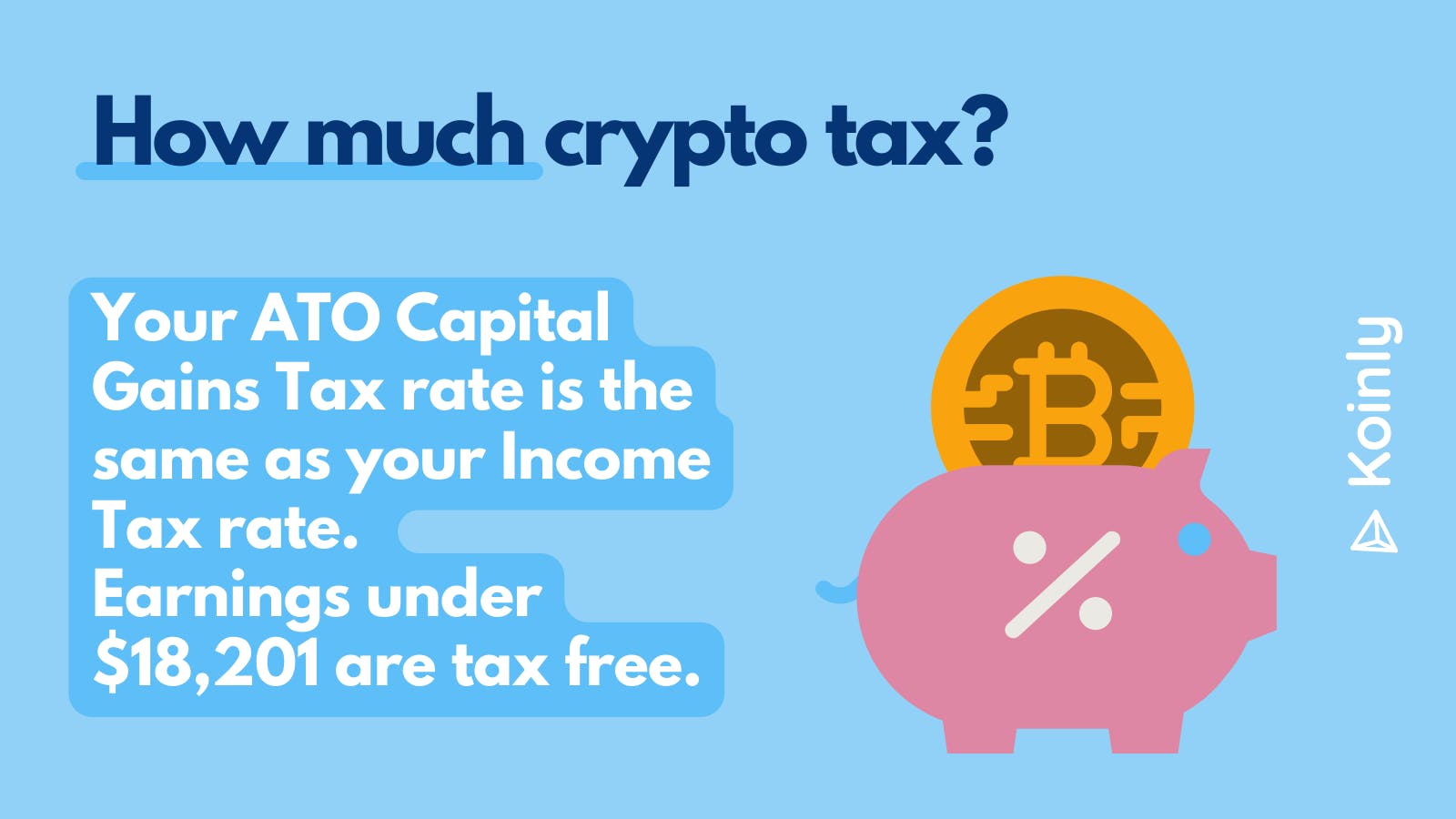

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

![]()

Ultimate Australia Crypto Tax Guide 2021 2022 Cointracker

30 Off Crypto Tax Calculator 1 Year Subscription Rookie 29 40 Hobbyist 76 20 Investor 149 40 Trader Compare Cards Credit Card Benefits Student Rewards

Doc S Consulting Ltd On Twitter Best Credit Cards Paying Off Credit Cards Credit Card Processing

Crypto Tax In Australia The Definitive 2022 Guide

Crypto Tax Free Countries 2022 Koinly

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Business Loan Should You Or Not

Bitcoin Price Prediction Today Usd Authentic For 2025

Pin On Graphics Design Tutorials

Cloud Service Provider Oracle Chosen By Australian Data Centres To Promote Secure Federal Government Workl Cloud Computing Services Cloud Services Oracle Cloud

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

How To Buy Cryptocurrency In Australia Buy Cryptocurrency Cryptocurrency How To Become Rich